- Alaskan Yachts

- Azimut Yachts

- Back Cove Yachts

- Beneteau Yachts

- Benetti Superyachts

- Bertram Yachts

- Boston Whaler

- Broward Yachts

- Buddy Davis Sportfish

- Burger Yachts

- Cabo Yachts

- Catamarans

- Carver Motoryachts

- Center Console

- Chris-Craft Yachts

- Cruisers Yachts

- DeFever Trawlers

- Dufour Sailboats

- Fairline Yachts

- Feadship Yachts

- Ferretti Yachts

- Formula Yachts

- Fountaine Pajot Cats

- Grady-White

- Grand Banks Trawlers

- Hargrave Yachts

- Hatteras Yachts

- Hinckley Picnic Boats

- Horizon Yachts

- Hydra-Sports

- Intrepid Boats

- Jarrett Bay Sportfish

- Jeanneau Yachts

- Kadey-Krogen Trawlers

- Lazzara Yachts

- Luhrs Sportfish

- Marlow Yachts

- Maritimo Yachts

- Marquis Yachts

- McKinna Motoryachts

- Meridian Yachts

- Midnight Express

- MJM Yachts

- Mochi Craft

- Neptunus Motoryachts

- Nordhavn Trawlers

- Nordic Tugs

- Ocean Alexander Yachts

- Offshore Yachts

- Outer Reef

- Oyster Sailing Yachts

- Pacific Mariner Yachts

- Palmer Johnson Yachts

- Pershing Yachts

Superyacht Market Analysis

December 2, 2017 11:55 am

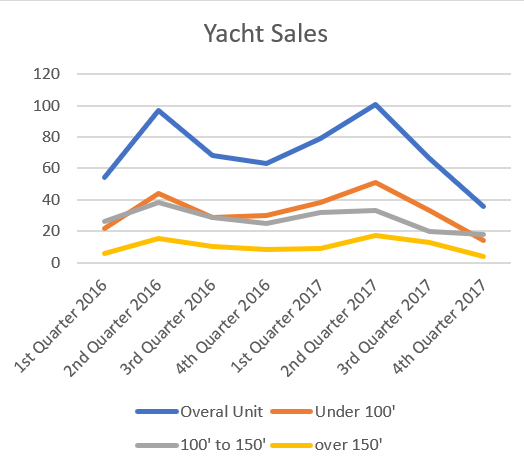

The global superyacht market (over 75’) seems to remain stable and slowly but steadily growing. While it hasn’t recovered entirely from the crisis of 2007, there are some very encouraging signs.

This year is on average a better year than 2016, by a few percent. Today, with a month still to go in 2017, the market has outperformed last year by $184.5 million.

Only the third quarter of 2017 underperformed compared to 2016, by 2.9%, and only in the 100’ to 150’ segment. The third quarter of 2017 included Hurricanes Irma & Maria, which dramatically slowed the general interest in yachting. However, the number of sales in the under 100’ and over 150’ categories remain unchanged, lifted by sales outside of Florida.

It seems that the sales that didn’t occur during this quarter are occurring in the fourth quarter of 2017. Proportionally the sales of this unfinished quarter are higher than last year’s one. Examples of these delayed sales include the 2 Lazzaras sold in the fourth quarter of 2017.

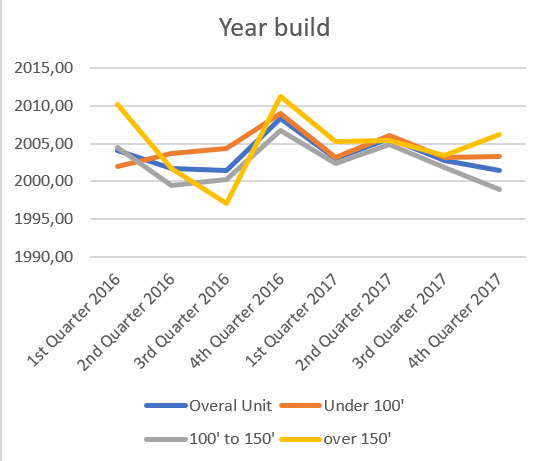

Regarding the year build of the yachts for sales, the market saw a pike in 2016 of younger yachts for sale, with a launch in 2008 on average. The presidential election seems to have influenced this spike. This was linked to an increase in pricing of such yachts.

This is especially observed in the sales of superyachts over 150’, where the average build year of a superyacht sold was 2011, compared to 1997 in the previous quarter. Since then the age of the average brokerage boat rebounded at its historic level. There are traditionally two peaks in the age of yacht sold in the first and fourth quarter, during the winter season, when younger yachts sell.

The average length of the yachts sold is holding very steady, with variations under 5% across the overall segment. The 100’ to 150’ segment is just as steady as the overall segment with variations just under 5%. In the larger yachts segment, the size of the yacht sold is fluctuating due to the smaller size of the population studied. With under 20 yachts sold per quarter, one sale can influence the entire segment.

Overall the prices have grown, by almost $300.000 across the entire market. Prices have however dramatically fallen for larger vessels, after a peak in the first quarter of 2017, highlighted by the sale of Solandge, which reportedly was asking $150,000,000. It however seems unlikely the yacht was sold at that price, after being for sale with Burgess at $90,000,000 for a year.

Regarding the turnover of the market, each quarter outperformed the same one of 2016 until now. As the last quarter of 2017 isn’t finished we cannot give final figures for now. However, the figures are very encouraging. As mentioned earlier the market outperformed the previous year by $184,500,000.

The most popular brands on the brokerage market include Sunseeker, Westport & Benetti. However, while these yards are still active, it is impressive to see that the market is active in yards that have closed, with Broward and Lazzara, both being the top sellers on the brokerage market, respectively No. 3 & 4. It is also worthwhile to note that these two brands are active almost exclusively in Florida and almost unknown in Europe.

The market is slowly but steadily growing, showing encouraging signs for the future of yachting.