- Alaskan Yachts

- Azimut Yachts

- Back Cove Yachts

- Beneteau Yachts

- Benetti Superyachts

- Bertram Yachts

- Boston Whaler

- Broward Yachts

- Buddy Davis Sportfish

- Burger Yachts

- Cabo Yachts

- Catamarans

- Carver Motoryachts

- Center Console

- Chris-Craft Yachts

- Cruisers Yachts

- DeFever Trawlers

- Dufour Sailboats

- Fairline Yachts

- Feadship Yachts

- Ferretti Yachts

- Filippetti Yachts

- Formula Yachts

- Fountaine Pajot Cats

- Grady-White

- Grand Banks Trawlers

- Hargrave Yachts

- Hatteras Yachts

- Hinckley Picnic Boats

- Horizon Yachts

- Hydra-Sports

- Intrepid Boats

- Jarrett Bay Sportfish

- Jeanneau Yachts

- Kadey-Krogen Trawlers

- Lazzara Yachts

- Lekker Boats

- Luhrs Sportfish

- Marlow Yachts

- Maritimo Yachts

- Marquis Yachts

- Mazu Yachts

- McKinna Motoryachts

- Meridian Yachts

- Midnight Express

- MJM Yachts

- Mochi Craft

- Neptunus Motoryachts

- Nordhavn Trawlers

- Nordic Tugs

- Numarine Yachts

- Ocean Alexander Yachts

- Ocean King

- Offshore Yachts

- Outer Reef

- Oyster Sailing Yachts

- Pacific Mariner Yachts

- Palmer Johnson Yachts

State of the Yacht Market Report: Q2 2025

Market Momentum Remains Solid

Looking back at our Q1 2025 report, the superyacht brokerage market displayed notable growth in the first quarter of the year, momentum that has decisively carried into the second quarter. The market demonstrated sustained buyer confidence and robust transaction activity, with growth in both sales volume and market value compared to the same period last year.

Superyacht (78ft+) Sales Performance Overview

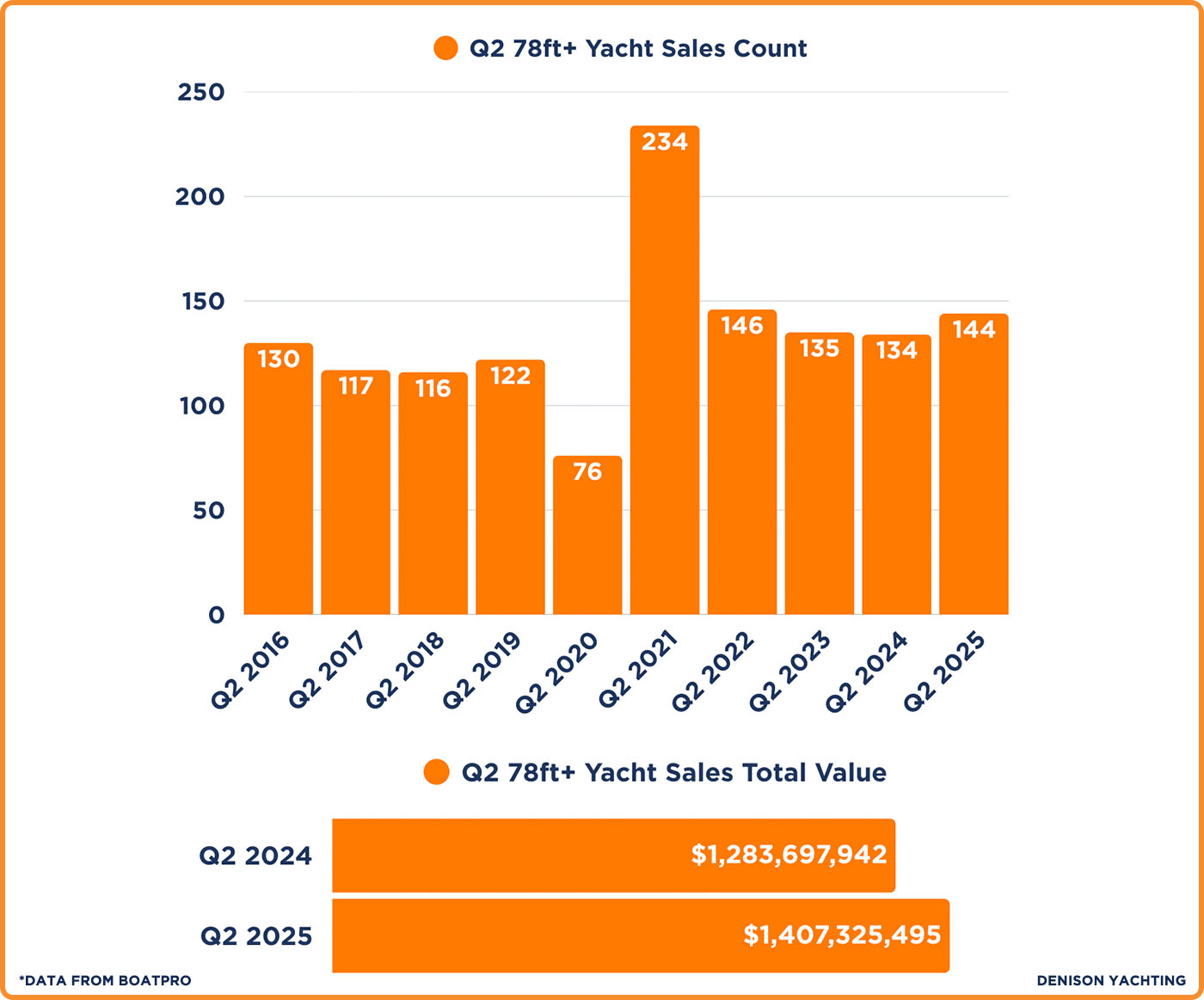

The first quarter of 2025 experienced an impressive increase in global yacht sales from the prior year, with 125 yachts sold in Q1 2025 compared to 87 yachts in the same period the previous year. This growth trajectory continued into Q2 2025, with 144 yachts changing hands compared to 134 in Q2 2024. Notably, 2025’s Q2 volume now outpaces every Q2 since the record-setting 2021 pandemic spike, underscoring durable demand in the brokerage market.

New-build deliveries provided additional support to the brokerage pipeline, with 13% of Q2 2025 transactions being first-time sales versus 10% a year earlier, reflecting shipyard backlogs clearing and feeding fresh inventory into the market.

The aggregate sales value of yachts sold climbed to roughly $1.41 billion, a 9.6% increase year-over-year.

Of the 144 yachts sold in Q2 2025, the average number of price reductions per yacht was 1.2, with an overall average reduction percentage of -12.1% off original asking pricing. Compare this to Q2 2024, where we saw an average of 1.23 price reductions per yacht at an average -10.7%.

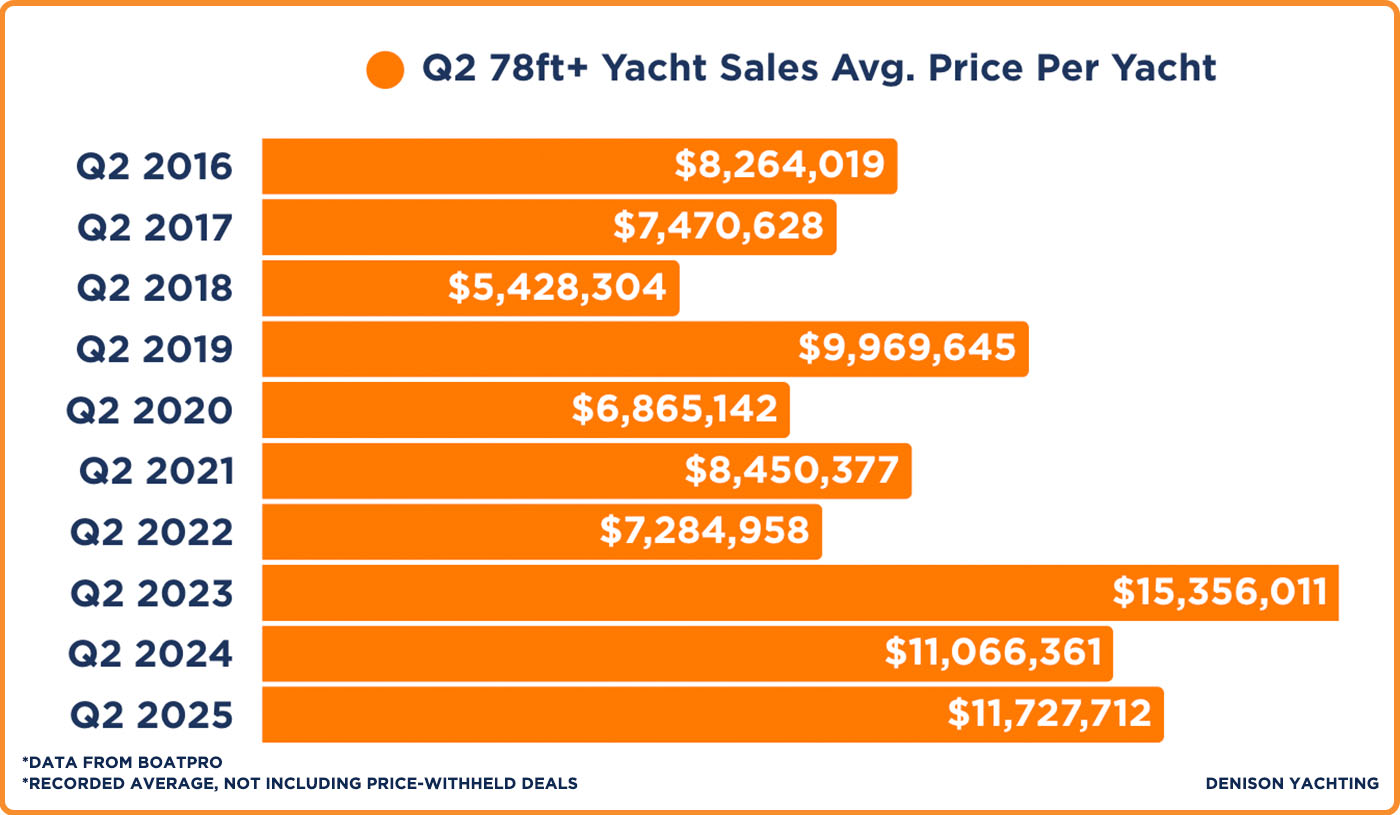

The average sale price ticked up to over $11.7 million compared to just over $11 million in Q2 2024. While a stretch away from the average sale price of over $15 million in Q2 2023, zooming further out shows the past three years had significantly higher averages than years prior.

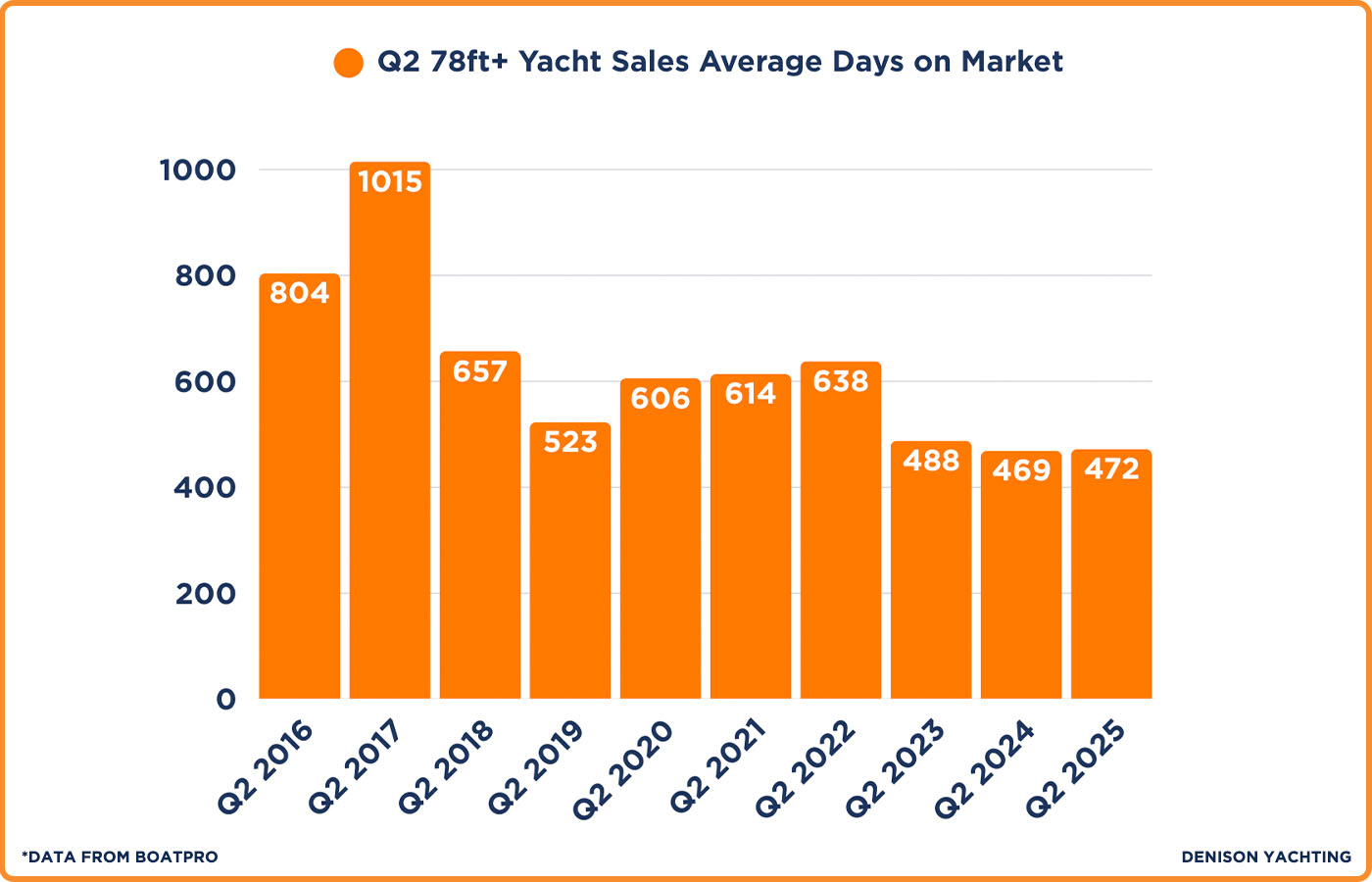

An important factor during this period was the average time sold yachts were on the market, which only slightly increased to 472 days in Q2 2025 from 469 days in Q1 2024. Zooming out, this represents a substantially shorter market duration compared to historical industry averages over the past nine years.

Regional sales highlights show Florida and the Southeast US maintaining their position as the world’s busiest brokerage hub, with 37 deals in Q2 2025 compared to 31 in Q2 2024. Sales increased year-over-year in the Western Mediterranean region as well, with European buyers accelerating transactions before the summer season, recording 25 sales in Q2 compared to 20 the previous year. The Eastern Mediterranean region showed a slight decline with 11 recorded sales in Q2 2025 compared to 14 in Q2 2024.

Denison Yachting Performance Highlights

Denison Yachting delivered another strong performance in Q2 2025, closing 13 yacht sales valued at approximately $74 million, up 23% from the year prior. Sold Denison yacht listings averaged just 302 days on the market in Q2 2025, beating the global benchmark by 170+ days. This reflects Denison’s effective strategies, extensive market knowledge, and robust client relationships.

Highlight sales for Denison this quarter include the 156′ Trinity 2004 MIRABELLA, 41m Westport 135 RPH New Build, and 121′ Custom Line 2019 EROS available now for charter with Denison.

Outlook for Q3 2025 and Beyond

The superyacht market’s robust Q2 performance positions the industry favorably heading into the traditionally active third quarter. However, the global landscape entering Q3 2025 presents both opportunities and challenges that warrant careful consideration as we analyze market prospects.

Global Economic and Political Developments: The economic environment for Q3 has been significantly shaped by major policy developments. President Trump’s “One Big Beautiful Bill,” signed into law on July 4, 2025, represents the largest tax cut in history for middle and working-class Americans, with families potentially seeing $10,000+ more in annual take-home pay and eliminating taxes on tips, overtime, and Social Security benefits. This substantial fiscal stimulus could meaningfully boost disposable income among potential yacht buyers, particularly in the US market.

However, these domestic gains must be weighed against ongoing international trade tensions. Trump has continued his aggressive tariff strategy, sending letters to trading partners threatening tariff rates of up to 40% on various countries, with the most recent deadline extended to August 1, 2025. The federal government collected $27 billion in tariffs in June 2025 alone, compared to $6 billion the previous year, indicating the significant scale of these trade measures.

Cryptocurrency Market Dynamics: The digital asset landscape presents a particularly compelling opportunity for the superyacht sector in Q3. Bitcoin has reached new all-time highs above $120,000 in July 2025, with the cryptocurrency market cap hitting $4 trillion for the first time. Bitcoin now commands 59% of the total crypto market valuation, with analysts targeting $142,000 despite current resistance levels. For Denison Yachting, recognized as the most crypto-friendly firm in the industry with a record of crypto transactions, this unprecedented wealth creation in digital assets represents a significant opportunity to serve newly affluent cryptocurrency holders seeking to deploy their gains into luxury assets.

Geopolitical Considerations: The ongoing Ukraine-Russia conflict continues to influence global markets, with fighting entering its fourth year and recent peace talks in Istanbul failing to yield progress toward a ceasefire. President Trump has given Russia until September 2 to show serious progress toward peace, threatening “very severe” sanctions and secondary tariffs of up to 100% on Russia’s trading partners. While this creates uncertainty, historical analysis shows that geopolitical tensions initially cause market volatility but often result in Bitcoin and luxury assets surging to new highs as investors seek alternative stores of value.

While global developments warrant cautious optimism, the fundamental drivers of superyacht demand—privacy, experiential luxury, and wealth preservation—remain compelling in an environment of policy uncertainty and digital asset appreciation. Firms with strong crypto capabilities and international market knowledge appear best positioned to capitalize on these trends through Q3 2025.

Speak With A Superyacht Specialist